Mortgages – what’s on offer?

There are many types of mortgage currently available in the marketplace – some you will be familiar with, some you may not be aware of. As we regularly check what’s on offer from lenders and keep abreast of developments and new products, we’re well-placed to recommend the right type of mortgage to meet your needs.

Repayment mortgage

the most popular and most widely available option, where you make monthly repayments for an agreed period of time until you’ve paid back both the capital and the interest.

Interest-only

with this type of mortgage, you only pay interest and at the end of the mortgage term you still owe your lender the amount that you borrowed, so you’ll to have plans in place to repay the original loan.

New build mortgages

if you’re thinking of buying a new build property, there are many things to consider. Contact us to explore the advantages and disadvantages.

Remortgages

in some cases, homeowners can save hundreds of pounds a year by moving their mortgage to a more attractive rate with a different lender. Remortgaging can also work if your property has increased in value and you want to free up some cash from the equity tied up in your home, or if you want to make higher repayments to shorten your mortgage term.

Buy-to-let mortgages

more and more people are becoming landlords and investing in property to rent out. If you’re thinking of doing this you need to take out a mortgage specially designed for this type of purchase.

The Financial Conduct Authority does not regulate on Some Buy To Let Mortgages

Let-to-buy mortgages

in essence, this type of mortgage arrangement means you can rent out your existing property, allowing you to take out a mortgage for a new home using the rental income to cover the cost.

Large mortgages

if you need a mortgage for over £1m, then we can introduce you to the lenders and private banks which specialise in catering for larger, more complex financing deals. We can help you source the most suitable terms and a mortgage that fits your particular circumstances.

Foreign national mortgages

if you are a non-UK national and want to invest in the UK property market, we can help you find the specialist mortgage you will need to buy a property here.

So, if you are looking for mortgage, give us a call to discuss.

To download a copy of our FactFind that needs to be completed with our broker click here

0208 297 9511

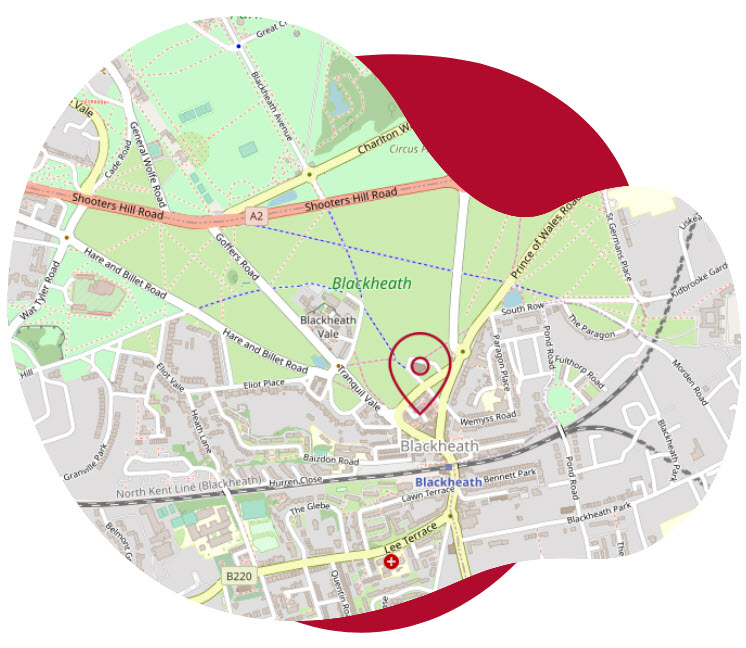

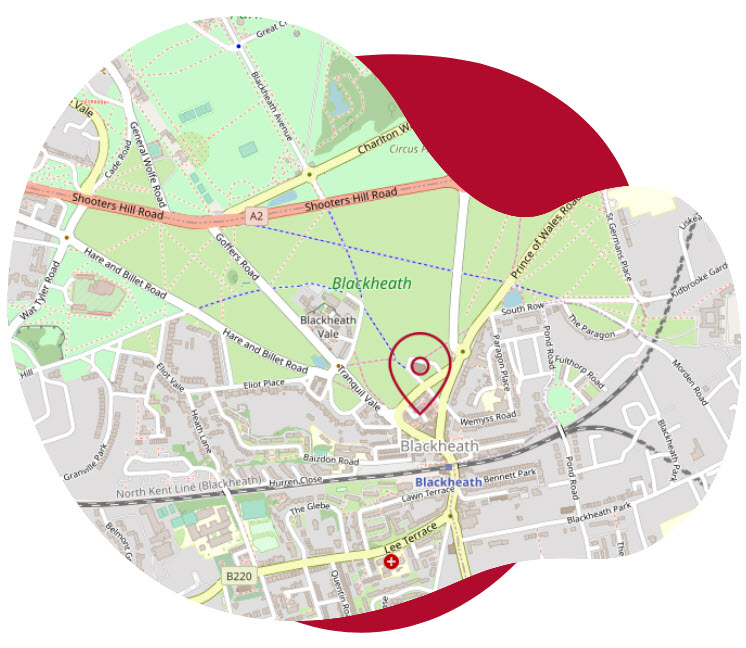

Brigade House,

Brigade Street,

Blackheath Village, London SE3 0TW.