Income Protection

This provides income where you are ill or injured, and as a result your income through employment or your normal route stops. If Houseperson’s cover is included, then it will pay out upon illness or injury, irrespective of any income stopping.

It is designed to replace most of your net income.

Cover lasts for either a set term in whole years, or to a given age (typically your state retirement age). The amount you pay is called the premium. It can either be guaranteed not to change, or it can be reviewable. Reviewable cover normally changes based on the claims experience of the life assurance company.

Critical Illness

Insurance that pays out when a defined medical event occurs. For example, following a heart attack, stroke, cancer or some other specifically defined critical illness.

Cover is for a set term, which may be equal to a mortgage term, for when children have grown up, until retirement or another life stage milestone. It may be worth considering having one policy for a set term to cover the mortgage, and another that will provide money to help provide for your different lifestyle if a serious illness happens.

Most people choose a lump sum to be paid out. There is the option of receiving it as set income over the term remaining, which is often a lower cost option.

Life Assurance

This is cover that pays out on death. Some plans pay upon earlier confirmation of a terminal illness where the prognosis is death within 12 months. It can pay out as a lump sum, or as income for the remainder of the policy term.

Cover can last for a set term called Term Assurance, or can last throughout life, called Whole of Life.

The amount of cover can remain the same or increase / decrease annually. Level term assurance stays the same throughout. Decreasing cover is sometimes used to cover a reducing debt, such as a repayment mortgage and usually assumes a given interest rate. Provided your mortgage rates don’t exceed that rate, then the cover should reduce at around the same rate as the mortgage. The amount you pay is called the premium. It can either be guaranteed not to change, or it can be reviewable.

Reviewable cover normally changes based on the claims experience of the life assurance company.

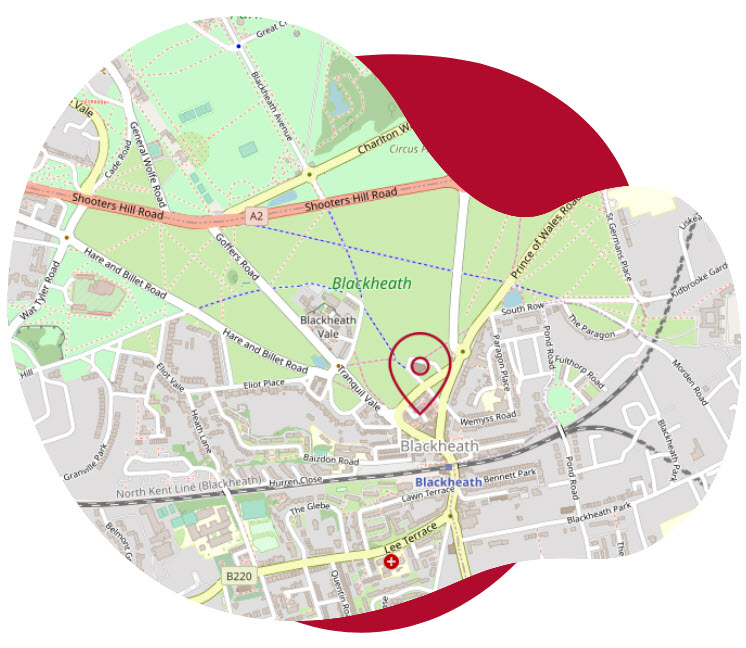

0208 297 9511

Brigade House,

Brigade Street,

Blackheath Village, London SE3 0TW.